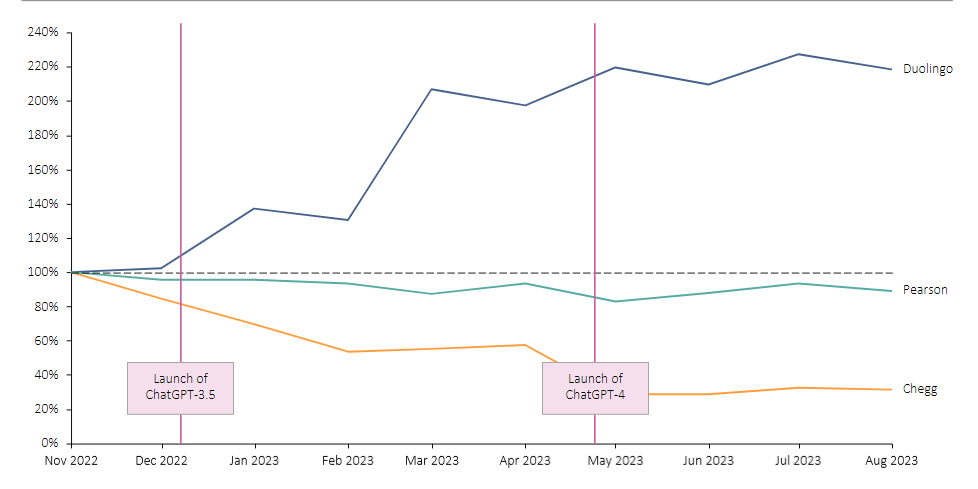

Chegg, Pearson, and Duolingo, three listed education companies, illustrate how business models are affected by generative AI in different ways. All three have publicly embraced AI, yet each has been impacted differently and experienced very different market reactions (Figure 1). Chegg has openly admitted being negatively impacted, while investors appear neutral regarding Pearson’s AI strategy, and Duolingo thrives. So, what factors determine whether AI is an opportunity or a threat to an education business?

Market capitalization index by provider, November 2022 – August 2023

Figure 1

Back in 2021, a global Ipsos survey estimated that education and learning will be the industry most affected by AI across the next 3-5 years, with 77% of respondents expecting AI to enhance education and learning, albeit this view has become more mixed since the launch of ChatGPT. Existing AI tools can enhance the learning experience of both learners and instructors in a variety of ways, as shown in Figure 2. At the same time, the ability of AI to curate personalised learning experiences that are tailored to the needs and preferences of the learner is revolutionising the sector and has created both opportunities and threats for education businesses.

Role of AI in Learning and Development

Figure 2

Since the emergence of ChatGPT and other LLMs, Chegg, Pearson, and Duolingo have all shown an inclination to harness the power of generative AI to improve investor confidence. Chegg have sought to rebrand themselves as a trusted intermediary between students and ChatGPT by partnering with Open AI to build a virtual tutor, CheggMate, which draws upon Chegg’s database of human-vetted answers. Duolingo’s share price increased by 59% between February and March 2023 following the announcement that a new product, Duolingo Max, would be powered by GPT-4, which seemingly assured investors over Duolingo’s willingness to embrace AI to improve their products. Pearson have historically used AI across its product portfolio and have developed a strategy to further integrate generative AI across its products. Notable projects include developing proprietary predictive algorithms to assess skills trends globally and using proprietary content to answer questions and guide users through learning areas. Pearson are also developing an AI-powered open-response assessment tool for English Language Learning alongside a conversational AI tutor to assist with speaking practice.

So, is Generative AI an opportunity or a threat?

We believe that the following five factors are key to whether AI should be perceived to be a threat or an opportunity by executives and investors in education companies:

- Brand strength

- Track record as a tech disruptor

- Extent of certification in product portfolio

- Scale and uniqueness of data moat

- Capability in pedagog

Brand strength is a function of the size and loyalty of the businesses’ user base. Education businesses that have forged a strong reputation as trusted providers and experienced high levels of customer satisfaction will be more likely to navigate their existing user base through the transition towards generative AI. Most customers, especially B2B customers, would prefer to use a tried and tested solution rather than risk their learning on free AI-powered chatbots that have a track record of making mistakes. Duolingo, for example, can leverage its powerful brand with c.70% of online education service users in the UK aware of the brand according to a 2022 survey.

At times of digital disruption, investors look for businesses and management teams with a track record of successful digital innovation and transformation. While legacy traditional players, like Pearson, may have their grand AI plans viewed with some scepticism by investors, digital-first businesses, such as Duolingo, will be more easily believed with good reason. Duolingo have been building their AI team for over 10 years and have already developed AI systems ranging from creating course content to adaptive assessment and AI tutoring. Meanwhile, entrenched business models may be viewed as brittle in the face of change. The barriers to entry for new educational content providers, for example, have come right down. Both Pearson and Chegg have sought to address this head-on by over-communicating their AI strategy to investors with mixed results.

Qualifications and assessment will retain their value far better than content in the face of AI. The way in which assessments are delivered may well change, however, as digital adaptive testing becomes commonplace. Furthermore, the Duolingo English Test leverages AI not only in its delivery but also in its creation, scoring and security. Issuers of trusted certifications, such as Pearson and Duolingo, hold a privileged position. Barriers to entering high-stakes summative assessment are high, although new players do break into these markets, as shown by both Pearson and Duolingo breaking up the IELTS and TOEFL duopoly in English language assessment.

The scale and uniqueness of proprietary data can provide some advantage to businesses that have meticulously collected and stored information over the years and now seek to train their own AI solution. Given that the knowledge base of large language models (LLMs) is limited to the information in its training dataset, it can be prone to hallucinations; fabrications which are particularly dangerous in an educational setting. In theory, the more accurate data the LLM can be fed, the more accurate and reliable it will be. For example, Chegg’s stated defence against being made obsolete by AI in the short term is the fact that it can draw upon student-generated answers and explanations to textbook questions since it was launched in 2006. This may lead to opportunities for content businesses that are able to draw upon an extensive bank of proprietary data to build a unique and accurate AI product.

However, businesses are prone to overestimating the value of the data they hold and must navigate a complex landscape of LLMs. Shares in Chegg have continued to fall despite the announcement of CheggMate, which suggests that the market does not perceive Chegg’s data moat to be particularly strong.

Businesses may seek to either build their own proprietary LLMs using internal datasets or alternatively plug into existing LLMs. There is a trade-off between speed, cost, and protecting one’s data moat. While OpenAI allows for businesses to create their own instance of the LLM and protect their data, other useful systems do not, which risks data leakage. The cost of interacting with third-party LLMs, such as OpenAI, can be steep, which is driving some towards building their own. Duolingo is betting on continuing to use OpenAI in the hope this will make them more agile and the costs will eventually come down.

Edtech businesses will increasingly require a strong pedagogy to differentiate themselves as AI seeks to commoditise content production. AI will reduce the time and costs associated with the development of educational content. In a heavily fragmented market, this is likely to accelerate the trend towards commoditisation of content. As a result, the most effective AI learning products will be those that guide learners through the learning process (i.e., the best pedagogy), not those that solely give you the most precise answer (i.e., the best content). Trusted course designers, such as Pearson, will continue to be valued for their understanding of pedagogy.

There are a multitude of factors affecting value creation and stock performance, not least the business’ underlying financial performance. However, we believe that the strength of an education business’ brand, technical expertise, pedagogical approach, and data moat, alongside providing certification, will be important in assuring generative AI is an opportunity rather than an existential threat.

If you would like to learn more about Cairneagle’s education practice, get in touch.